Singapore’ VCC fund structure: a “differentiating factor”

Singapore’s VCC structure has become a credible alternative to traditional regimes

Singapore’s Variable Capital Company (VCC) has, in just five years, become a globally competitive corporate fund structure for a diverse array of investment strategies, positioning the city state as a leading onshore hub for asset managers seeking connectivity to Asia’s capital markets.

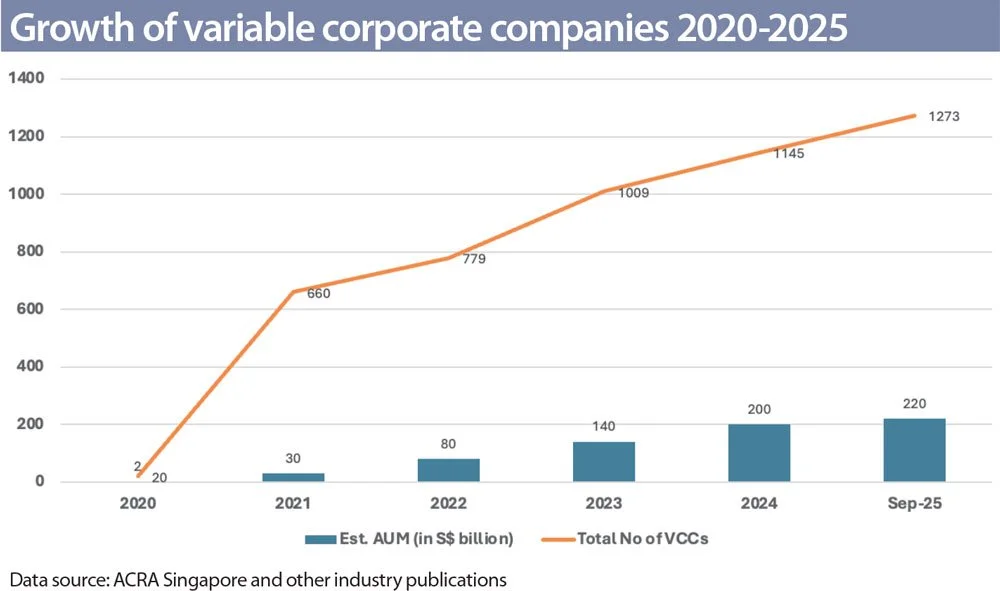

The structure was launched in January 2020 with 20 pilot funds. As of September 2025, it had attracted over 1,270 entities and 2,700 sub-funds with total assets under management estimated at more than S$220 billion (US$170 billion). It represents 3.6% of Singapore’s S$6 trillion asset management industry and is one of the fastest growing components of the financial sector.

The VCC ecosystem now spans private equity, venture capital, hedge funds, retail mandates, and family offices, with environmental, social and governance principles overlaying across asset classes.

Private equity and venture capital account for over 40% of VCC mandates, followed by about 18% in hedge funds and around 16% in retail funds. The rest are mainly family offices and multi-asset mandates.

More than 630 licensed fund managers now operate VCCs in Singapore. Leading institutions like DBS, UOB, Fullerton and BlackRock anchor the mainstream segments, while a growing number of independent specialists, such as Aura Group, Quant Matter and Alphanode Capital, are facilitating investments in private credit and digital assets

Advantages

The VCC was jointly developed by the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) to address the rigidity of legacy structures such as limited partnerships and unit trusts.

The variable capital feature of the structure sets it apart from conventional corporate entities. It enables share issuance and redemption without shareholder approval, and permits dividends to be paid from capital rather than profits alone. This liquidity and payout flexibility is critical for many fund operations.

A VCC may be structured as a standalone fund or, more commonly, as an umbrella housing multiple independent sub-funds governed by one board of directors and operated by one fund manager.

Each sub-fund maintains legally segregated assets and liabilities and may adopt separate investment strategies, investor bases, fee structures, and even accounting standards. This design delivers significant cost efficiencies while allowing for tailored strategies for each sub-fund.

It is also a regime that demands rigorous compliance. Every VCC must appoint a fund manager licensed under the Securities and Futures Act, as well as a resident director, company secretary and auditor. MAS also enforces strict anti-money laundering and countering financing of terrorism requirements, providing robust oversight.

The balance between operational flexibility and transparent compliance position the VCC as a credible vehicle for sophisticated investors while upholding Singapore’s standing for financial integrity.

Re-domiciliation

Tax neutrality and international access further enhance the VCC’s appeal.

Singapore’s extensive network of double taxation agreements offers broad treaty relief. Fund managers benefit from tax exemptions on certain management and performance fees as well as preferential treatment for the goods and services tax, while investors enjoy exemptions on capital gains and dividends.

These provisions make the VCC a favourable alternative to offshore vehicles that face challenges related to withholding taxes and limited treaty protection.

The VCC also facilitates re-domiciliation of existing offshore funds that have similar structures to Singapore without disrupting operations. To encourage this, MAS and ACRA launched a grant scheme in 2020, providing co-funding of up to 30% of qualifying setup costs, capped at S$30,000 per fund, for VCCs established with local service providers.

The scheme ended in January 2025 with about 220-250 funds, representing 16%-18% of all VCC entities, having completed re-domiciliation, predominantly from the Cayman Islands, Delaware and Guernsey.

While shareholder registers remain confidential, MAS retains statutory access rights, striking an effective balance between investor privacy and regulatory accountability.

Flexibility

The VCC’s inherent flexibility has proven invaluable across a wide spectrum of investment mandates.

In private equity and venture capital, modular sub-fund structures allow managers and investors to delineate exposures by geography or sector and to launch new sub-funds as market conditions evolve.

Hedge funds can utilise umbrella structures to diversify strategies within a single legal entity, streamlining governance and reporting.

Family offices benefit from the ability to segregate generational assets while maintaining confidentiality and consolidated oversight.

Real estate and infrastructure players can leverage sub-funds to optimise project compartmentalisation and financing, while renewable energy and ESG-focused managers can transparently report their impact ring-fencing portfolios.

There is also growing interest in the VCC among banks, insurers, sovereign wealth funds and pension-linked vehicles.

In 2023, Singapore sovereign wealth fund GIC partnered with UK-listed private equity firm 3i Group to establish a VCC for treaty-efficient co-investments across Asia. This VCC’s segregated liability framework enabled 3i to isolate deal-specific risks while leveraging Singapore’s double taxation agreements with key jurisdictions such as Japan and India.

The model is being replicated by other pension-linked and sovereign wealth fund investors.

Leading in Asia

The VCC structure has become a credible alternative to traditional offshore jurisdictions like the Cayman Islands, Ireland and Luxembourg for Asia-focused funds, though it remains modest by comparison.

As of September 2025, Luxembourg hosted 1,515 UCITS funds with over 3 trillion euros ($3.45 trillion) of assets.

The Irish Collective Asset-management Vehicles or ICAVs held more than 2.5 trillion euros across 583 vehicles, and the Cayman Islands oversaw approximately 1,400 Segregated Portfolio Companies with an estimated $3.5 trillion–$4 trillion.

But within Asia, the VCC is leading compared with regional alternatives like Hong Kong’s Open-ended Fund Company (OFC).

Introduced in 2018, the OFC had only 626 registered entities as of September 2025 with an estimated HK$120 billion ($15.5 billion) in assets, primarily consisting of private, single-strategy funds with modest capital.

The OFC serves China-focused strategies and retail exchange-traded funds effectively, but the VCC’s broader tax treaty network, smoother re-domiciliation process, and deeper ecosystem of legal, audit, and administration talent has made it the preferred choice for global asset managers.

Australia’s Corporate Collective Investment Vehicle (CCIV), introduced in 2022, has seen slow uptake compared with VCCs and OFCs due to a 30%-45% withholding tax for foreign investors. It has primarily been used by onshore superannuation funds.

Regulatory updates made to the CCIV regime in 2025 allow for greater operational flexibility and reduced compliance burden. The government has also negotiated mutual recognition agreements with Singapore and the UK, making it easier for CCIVs to market products offshore.

Broadening access

Nevertheless, the VCC is facing some challenges.

New entrants may underestimate its operational complexity and compliance demands.

The surge in fund launches and migration has also heightened competition for talent in fund administration, legal structuring and compliance. To address this, MAS works closely with industry groups to build a strong, sustainable pipeline of local talent for the fund management ecosystem.

Some institutional investors remain cautious given limited precedent in cross-border insolvency cases. And evolving global tax rules are prompting managers to reassess cross-border structures.

MAS has responded with intensified reviews and reinforced expectations regarding economic substance and governance. It is also piloting tokenised VCCs under Project Guardian to explore blockchain-based fund issuance and settlement.

Discussions are also underway to broaden VCCs’ access to retail investors and to participate in the ASEAN Collective Investment Scheme. This would facilitate passporting across the five Southeast Asian members of the scheme by 2027.

“The VCC has become one of Singapore’s key differentiators as a global asset management hub,” Tan Kok Ming, an executive director of MAS, told an asset management industry forum in July. “It also reflects our commitment to develop innovative solutions to meet the evolving needs of the industry.”

*This article was published in Asia Asset Management’s December 2025 magazine titled “A differentiating factor”.