China’s fund industry reshapes

China's mutual fund industry grapples with fee reform and changing investor behaviour

China’s multitrillion-dollar mutual fund industry is undergoing a seismic transformation that seeks to redefine the rules of the game and push the sector into a new era of competition based on performance and investor value.

Up until two years ago, the industry had long thrived on explosive asset growth and fees that were far above global norms. That era came to an end in 2023 when the China Securities Regulatory Commission (CSRC) unveiled “Guidelines for Strengthening the Administration of Operating Charges of Securities Investment Funds” aimed at cutting costs for investors and making competition more transparent and merit-based.

The measures carried out over three phases recalibrate the incentive structure, shifting the focus from pure asset gathering towards performance and investor value.

Phase one, which was completed by July 2024, capped management fees for active equity funds at 1.2%, down from an average 1.5%, while passive funds were capped at 0.5%, down from a range of 0.5% to 1% previously. Custodian fees dropped to below 20 basis points, down from 25 basis points.

Phase two which was completed by the end of last year set stock trading commissions at a maximum 26 basis points for passive equity funds and 52 basis points for other funds.

Phase three, covering sales and trailer fees, is under consultation and aims to ban commission kickbacks.

Investors save

The fee caps mark a significant step towards aligning China’s mutual fund cost structure with other mature markets. The new fees now match or even undercut those in Hong Kong, where active equity fund management fee typically range from 1.25% to 1.75% and passive funds from 0.15% to 0.65%.

However, trading commissions remain substantially higher than in Hong Kong, where the range is between 0.5 basis points and 1.5 basis points.

Fees in China still have room to improve compared to the US, the largest market globally. US active equity funds typically charge management fees of 0.7%-1.2%, and only 0.03%-0.04% for broad-market passive funds. Trading commissions average just 0.1 basis points, or a flat per share fee.

According to Chinese financial data provider Wind Information Company, average annual management fee revenue per fund fell 5.4% to 4.95 million RMB (US$700,000) in the first half of 2025 from 5.23 million RMB in the same period of 2024, reflecting both direct fee cuts and a shift into cheaper products.

Analysts estimate that when all three phases are fully implemented by the end of this year, investors could collectively save around 50 billion RMB annually.

Changing structure

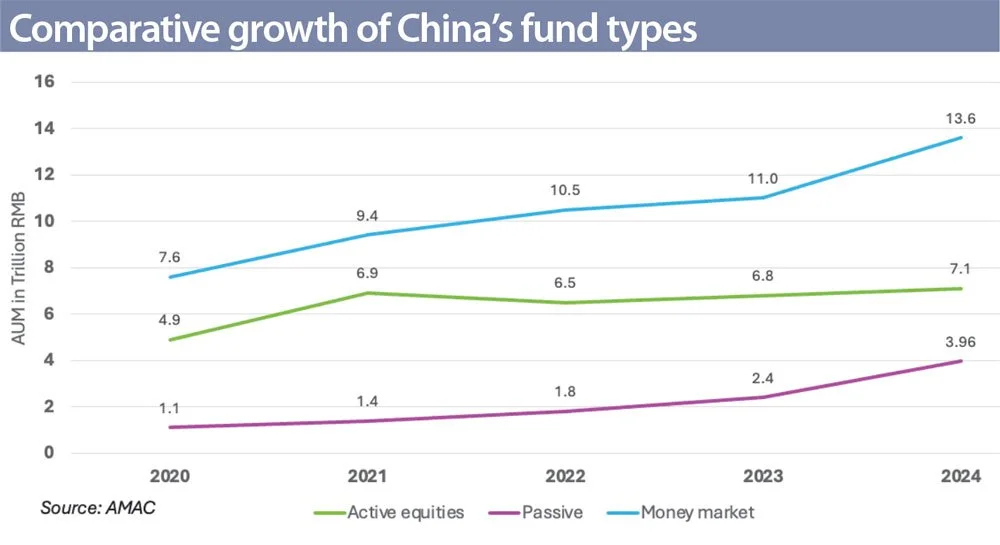

China’s mutual fund industry has shown remarkable resilience over the past five years in spite of the Covid-19 pandemic and a protracted economic slowdown. Total assets under management rose 59% to 31.89 trillion RMB by mid-2025 from 20 trillion RMB in 2020, according to figures from the Asset Management Association of China (AMAC).

This growth has been driven largely by low-fee passive and money market funds, while traditional high-margin active equity funds have stalled.

From 2020 to 2024, assets of passive funds surged 360% to 3.9 trillion RMB and assets of money market funds grew nearly 80% to 13.6 trillion RMB. Asset growth of active equity funds trailed, increasing 45% to 7.11 trillion RMB.

This development has created a profitability paradox: the industry is expanding fastest in the segments that yield the least revenue.

Historically, revenues of fund houses rose in lockstep with assets, but that link is breaking. A fund that once charged 1.5% now charges 1.2%, which means 20% lower revenue on the same asset base.

Managers must now grow assets by 25% just to maintain their previous revenue, a tall order in today’s competitive market.

Profitability has suffered even more. Fund management entails high fixed costs, covering salaries for top portfolio managers and research teams through to costs for compliance and technology. When revenue falls but costs stay flat, margins compress sharply. Smaller players lacking scale to spread these costs are the hardest hit.

Digital disruption

The rise of digital mutual fund platforms has accelerated this transformation.

For decades, a handful of large banks and brokers controlled distribution, inflating fees through high commissions. Digital platforms like Ant Fortune and Tiantian Fund Net have disrupted that model, creating a direct and transparent marketplace.

Investors can now compare hundreds of funds on their mobile phones, viewing performance charts and fee rates side-by-side. Investing has become a buyer’s market, forcing fee differences into the open.

This digital disruption had been driving fee reductions long before the CSRC mandates made them compulsory. Digital platforms also serve as the primary educational channel for a new generation of investors, demystifying passive investing and popularising low-cost index strategies.

Scale champions like China Asset Management, E Fund, and GF Fund, each with over one trillion RMB of assets, can absorb revenue shocks through sheer economies of scale. They lead in both active management and the passive trend, using their financial muscle to launch low-fee exchange-traded funds that reinforce market dominance. Their strong brands attract organic flows on digital platforms without needing to pay for premium placements.

Their integrated models combining mutual funds, pension management and private wealth advisory also allow them to cross-subsidise retail products with higher margin advisory fees. GF Fund, for example, is known to bundle its ETF offerings with bespoke portfolio solutions for high-net-worth clients.

Passive specialists including China Southern and Huatai-PineBridge thrive on optimising low cost, high volume investing. Their focus and operational efficiency make thin margins sustainable as investors increasingly shift from pricey active products to transparent index funds.

Fund houses owned by large state-owned banks, such as CCB Principal and ICBC Credit Suisse, benefit from captive distribution networks. Their products are sold through thousands of branches with minimal customer acquisition costs, giving them a formidable edge.

The ones at risk

Mid-sized and small active managers are the most vulnerable in this environment.

The top 20 of China’s 140 fund houses control roughly 75% of total assets, leaving the rest to scramble for scraps. The number of “mini-funds” with assets below the 50 million RMB regulatory threshold for potential liquidation is rising.

According to AMAC, a record number of funds – more than 200 – were liquidated in 2024 alone. The industry expects the figure to reach a new high this year.

Most of these funds belong to smaller or mid-tier managers for whom the fee squeeze poses an existential threat.

Without scale, cost-efficient infrastructure, or strong distribution channels, these firms risk fading into obscurity on digital platforms. They are trapped in a vicious cycle: lower fees lead to reduced revenue, which hampers their ability to attract top investment talent, resulting in weaker fund performance and declining investor interest. Many are already operating at a loss, making takeovers or outright closures increasingly unavoidable.

Test for foreign players

Foreign-controlled joint ventures also face strong headwinds. Although backed by global companies, they occupy an untenable middle ground: too small to rival domestic champions, yet often misaligned with China’s fast-moving, retail-driven market. Their global brand prestige carries little weight on local retail platforms.

Their survival requires shifting away from broad retail offerings into areas where Chinese firms still lack deep expertise, such as niche institutional mandates, and innovative products like global macro strategies, smart beta, thematic investing and products linked to environmental, social and governance principles.

Allianz Insurance Asset Management, BlackRock Fund Management and PIMCO Investment Management are among the foreign firms that have successfully shifted towards institutional or high-net-worth mandates. The era of foreign generalists in China is coming to an end.

Growing pains

The mutual fund sector in the world’s second largest economy is evolving towards a structure that is familiar in Hong Kong and the US: top-tier players and focused specialists dominate, and the middle ground vanishes. Mergers and acquisitions are gaining momentum as a competitive shakeout looms, with several industry reports indicating ongoing discussions.

Scale, brand, operational agility and innovation are now decisive, enabling competitive players to flourish even with thinner margins. Leading managers are deploying artificial intelligence for investment research, personalised customer service, and risk management, seeking to unlock competitive advantages and new efficiencies to offset margin compression.

This shakeout marks a painful but necessary step in the maturation of China’s mutual fund industry. Investors welcome a new era of lower costs, greater transparency, and genuine differentiation. Industry players that fail to innovate, build scale, or sharpen their niche will not only fall behind but risk becoming obsolete.

*This article was published in Asia Asset Management’s November 2025 magazine titled “An industry reshapes”.